Popular Auto Insurance Companies In Texas

Texas is one of the most interesting and populous states in the United States, with a population of more than 27 million. Texas is a vast and diverse state with a population of more than 27 million. This makes it a lucrative market for auto insurance companies.

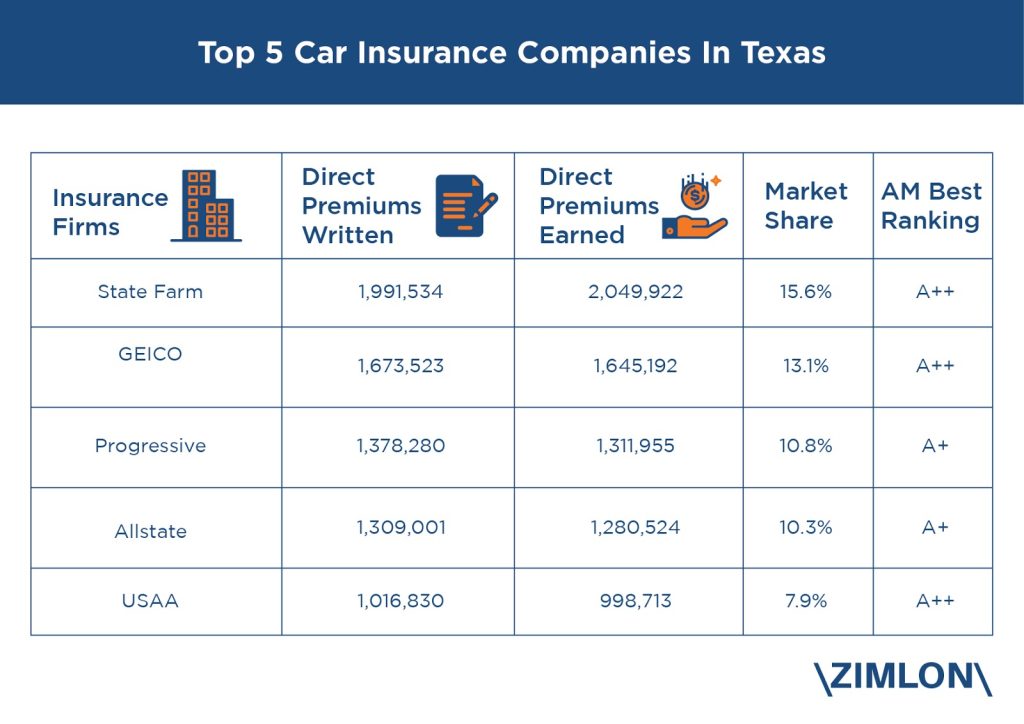

This makes it a lucrative market for auto insurance companies. In 2020, the top three auto insurance companies in Texas will become Allstate, GEICO and State Farm. These companies will account for more than 60% of all car insurance premiums in Texas. This article analyzes the ten most popular auto insurance companies in Texas in 2020 as premium and market share.

Why are these companies so popular?

Texas is a large state, and there are many types of auto insurance companies to choose from. But what is the most popular? A study shows that the five most popular auto insurance companies in Texas in 2020 will be Liberty Mutual, State Farm and GEICO. The total market share of these companies will be close to 50%!

In 2020, the most popular auto insurance companies in Texas will be Allstate, GEICO, State Farm and Liberty Mutual, depending on their premium and market share. These companies provide high-quality products at reasonable prices, so they are rated as the highest level. They also have strong influence in many markets in the state.

How to choose the right auto insurance company?

With regard to auto insurance, it is difficult to determine which company is best for you. There are many other factors to consider, such as insurance premiums and market share. As for the insurance premium, you’d like to see how much the company charges each year. This document describes how to select the right company based on two elements.

This cost information can help you understand how high the cost of insurance is. But not all companies use the same price. Some people may charge higher fees at the beginning, but they may lower the rate later, and others will get higher rates at the beginning. Before making a decision, companies should be thoroughly studied.

Here are the five most popular auto insurance companies in this field.

- Progressive insurance

By 2020, progressive insurance will become the most popular auto insurance company in Texas based on premium and market share. The company’s insurance premium in 2020 was 3.414 billion US dollars, accounting for 15.13% of the total auto insurance premium paid by Texas that year. In that year, Progressive held the largest market share among auto insurance companies in Texas, accounting for 17.14%. Progressive also offers a wide range of discounts and concessions to customers who participate in automatic insurance payments.

- National Farm Insurance:

In terms of premium and market share, State Farm is the other most popular auto insurance company in Texas. The company offers comprehensive automobile, motorcycle, ship and family and business insurance. State Farm is the most expensive auto insurance company in Texas, with an average annual premium of 302.3437339 million dollars.

- GEICO Insurance

Geico is the third most popular auto insurance company in Texas, with premium of 2.4 billion dollars and market share of 10.44% in 2020. Provide a variety of insurance products, including general liability insurance, property insurance and auto insurance. Geico also enjoys a high reputation for customer service and claim satisfaction.

- Allstate insurance

Quanzhou Insurance Company is the fourth most popular auto insurance company in Texas in terms of premium and market share in 2020. In terms of premium, universal insurance ranked fourth. The total premium collected in 2020 was USD 201646039. In terms of market share, universal insurance ranked eighth, with a market share of 8.94% in 2020.

- Texas farmer insurance premium: 134643508 Market share: 5.91%

According to the insurance premium and market share in 2020, Texas Farmer Insurance Company is the fifth most popular auto insurance company in Texas. In 2020, their premium will be 1.334 billion US dollars, with a market share of 5.91%. The company provides auto insurance for drivers of all ages, including motorcycles and campers.

Texas Farmers’ Insurance Company has a long history in the state, providing high-quality insurance products for Texans for a long time. In addition to its statewide business, Texas Farmers Insurance Company also operates a statewide network of more than 1000 independent agents. The company is committed to providing quality customer service and competitive prices.

Final idea:

It’s interesting to see other popular auto insurance companies in Texas. Some large companies(such as GEICO) have huge market shares, while other small companies are more common in some areas. As new companies enter and compete for customers, it will be interesting to see how the market share will change over time.