How To Make A Claim For Life Insurance In Western China

Founded in 1880, the Great Western Insurance Company is the best life insurance institution in Canada. In particular, Great Western Life and Canadian Life are currently the same company.

When the best insurance coverage is needed, Great Western Life Insurance Company is a trustworthy company in Canada. There are several benefits of great Western life groups. You can enjoy their personal plans and so on.

Great West Life employee benefit package is needed by the company’s employees to ensure the safety of the workplace at a low cost.

The group welfare products and services provided by Great West Life include medical benefits, dental care benefits, health and disability projects, small business solutions, life and accident death and fragment benefits, medical benefits for retirees, professional solutions and technical solutions for welfare projects.

Dental care benefits include basic insurance such as continuous care and maintenance, and major insurance such as bridges, crowns, mosaics, and dentures. In addition, malformation coverings such as plastic examinations, diagnostic radiographs, casts, x-rays, fixators, and dental coverings are available.

Life insurance options include employee life insurance, skin quantum term life insurance, option term life insurance and group life insurance conversion.

When looking for life insurance coverage, one of the best choices for Canadians is to get an insurance policy from a Canadian life insurance company. This choice should be seriously considered. Similarly, consumers looking for other financial solutions(such as those provided by Empower Retirement in the United States) may also rely on the expertise and security provided by the Great West.

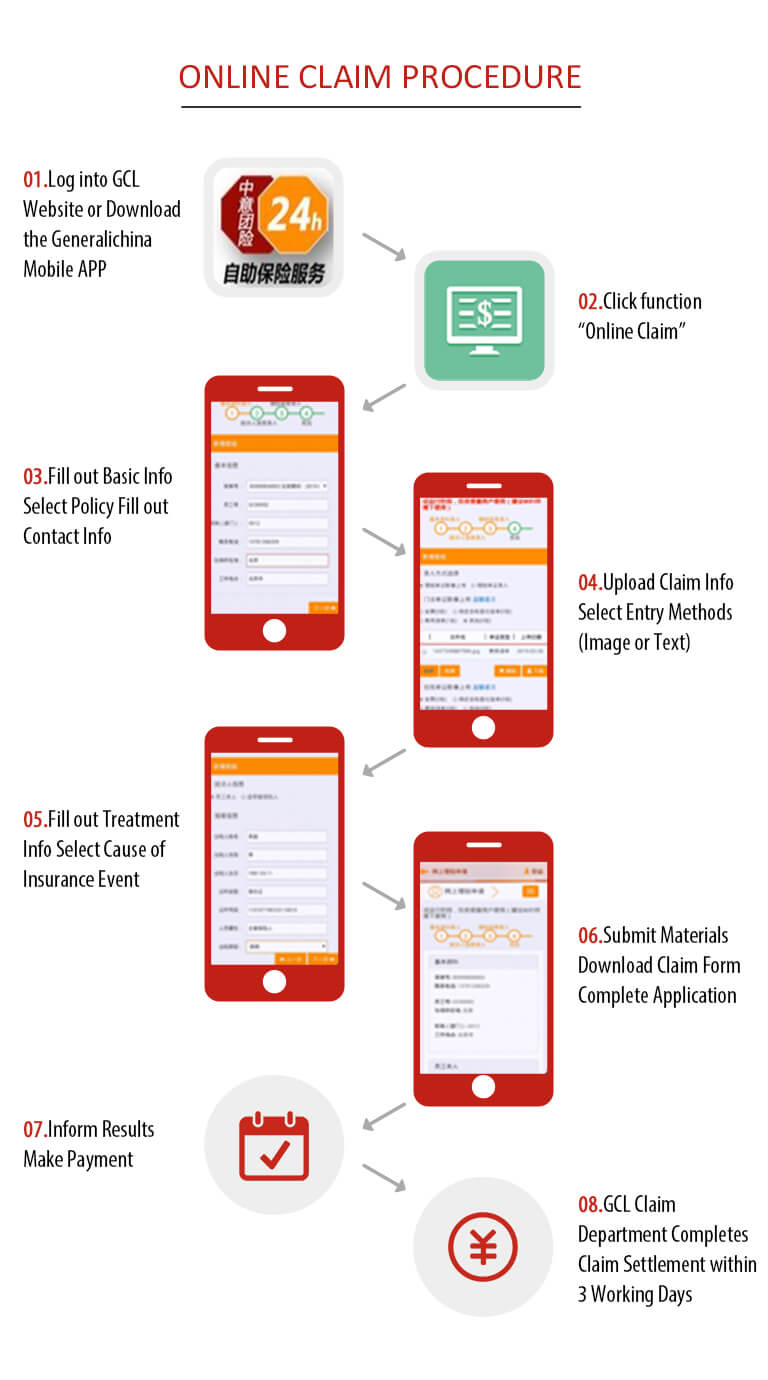

How to apply for Western Life Insurance

Please contact Great West Life customer service – 1800 957 9777. Direct payment medical product card: the main project participants will get a direct payment medical product card to expand the application scope of medical projects.