How To Invest In Stocks For Novices?

If you want to invest in the stock market, but do not know where to start, please continue reading.

$10000 software and The P500 index investment 50 years ago is currently worth about $1.2 million. If effective, stock investment can create long-term wealth. The method is as follows:

- Stock investment method

Stocks: If you have time and will, you can invest in specific stocks. Well, this is better. Smart and patient investors can beat the market for a while. If quarterly earnings reports and proper math don’t seem attractive, the passive approach can’t be wrong.

You can buy private stocks or index funds that track the S&P 500 index. We prefer passive funds to active fund management.(There are exceptions, of course.) Index funds reduce costs and replicate the long-term performance of their underlying indexes. The annual yield of the S&P 500 is about 10%, which may create wealth over time.

In recent years, robot consultants have become very popular. Robot consultants invest in index funds according to their age, risk perception and investment objectives. Many Robo consultants will optimize tax efficiency and improve it over time.

- Stock Investment Budget Settings

First, we will discuss stocks that you should not invest in. You should not invest the money you need in the stock market within five years.

In the long run, the stock market will rise, but the short-term stock price is too unstable. It is not uncommon for a drop of 20% within a year. During the covid-19 epidemic in 2020, the market fell by more than 40% and will recover in a few months.

-

Emergency savings account

-

The amount needed to pay the child’s tuition will be paid later.

-

Leave fund of the second year

-

Even if you are not ready to buy a house within a few years, you should set aside some cash as an advance payment as soon as possible.

investment.

Let’s talk about investing money we don’t need for five years. Asset allocation involves several criteria. Age, risk perception and investment objectives are key factors.

How old are you? As we grow older, stocks become less and less popular. Young people have experienced decades of market fluctuations, but retirees rely on investment income.

Here are the rules of thumb for asset allocation – 110 Your age, most of the funds that can be invested should be stocks(including stock based mutual funds and ETFs). The rest should be bonds or high-yield CDs. Modify this ratio according to risk perception.

Suppose you are 40 years old. The rule recommends investing 70% of the money in stocks and 30% in fixed income. If you are a risk taker or plan to work until retirement age, adjust this proportion to stock. If you don’t like huge portfolio fluctuations, you may want to adjust it.

- Investment account

If you can’t buy stocks, all the stock buying suggestions for novices are useless. I need an intermediary account.

These accounts are provided by e2yes, TD365 and other companies. It usually takes a few minutes to open an intermediary account. You can provide funds to your intermediary account through EFT, cheque or telegraphic transfer.

although it is easy to open an intermediary account, please consider the following matters before selecting an intermediary:

Account type.

You should first select an intermediary account. For most novices, this means choosing one of the intermediary accounts and IRA(IRA).

Both accounts can purchase stocks, mutual funds and ETFs. Why do you invest in stocks? How easy do you want to get your money?

Traditional intermediary accounts are required to easily obtain funds or invest beyond the annual IRA payment limit.

IRAs are useful for setting up retirement savings. Although the traditional IRA and Rose IRA also have SEP and SIMPLE IRA for self-employed and small business owners, they are two basic categories. IRA is a tax preference for buying stocks, but you can’t withdraw money before you get old.

Cost benefit analysis.

Most online stockbrokers cancel transaction fees, so most(but not all) of the fees are equal.

There are different differences. Some brokers provide guidance tools, investment research and other benefits to new investors. Other companies offer foreign stock transactions. Some companies are wired for the next quarter. If you want face-to-face investment guidance, this will be good.

Intermediary trading platforms are also important. Some more. Heavy “; i have used it more than others. If you can try the trial version before purchasing, please do so.

- Purchase of shares

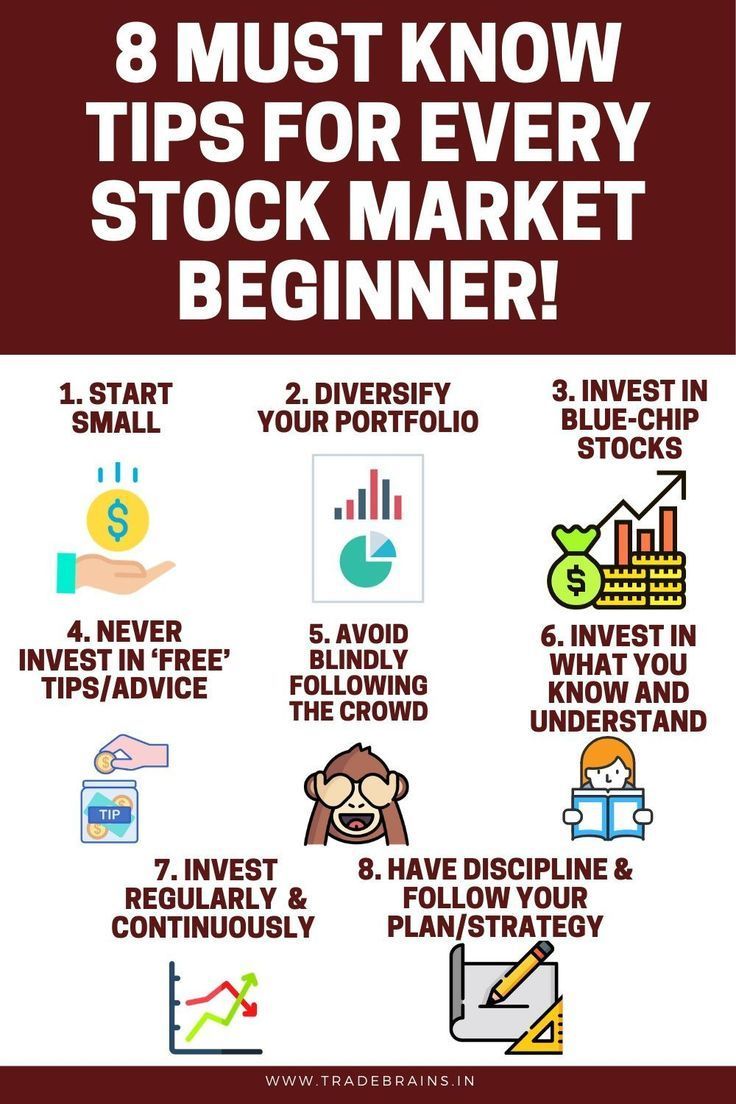

Since you know how to buy stocks, here are five investment options for beginners. You can’t include all the stock selection and analysis you need to know in a few pages, but the following are the basic knowledge:

-

Diversify your investments.

-

Only invest in companies that you fully understand.

-

Until you stay away from volatile stocks and master investment skills.

-

Stay away from low price stocks forever.

-

Understand the basic concepts and measurement standards used in stock evaluation.

Diversified product portfolio, including multiple companies. Too much diversity is dangerous. Stick to the company you know. If you are bullish on a stock, there is nothing wrong with having a fairly large portfolio in the industry.

Buying dazzling high growth stocks seems to be a good way to gain wealth(perhaps), but I suggest you buy them when you are more experienced. We recommend that you build your portfolio in a trusted and mature company.

- Additional investment

This is one of Warren Burbank’s investment secrets. Extraordinary results do not require extraordinary action. Warren Buffett is the most successful long-term investor in the world and an important source of investment advice.

Buy the stocks of excellent companies at a reasonable price and continue to hold them as long as they achieve outstanding results(or until you need money). You may experience some fluctuations, but over time, you will get good returns.