How Should Young People Invest?

As a new graduate, the first thing to do is to save as much money as possible. When I found my first job after graduation, I immediately bought the car I dreamed of – the new Mustang GT convertible. This is not my best financial decision; -) I revised the rest of the budget, but this time it’s too fascinating to resist. This is something you must guard against. Is to avoid the temptation to waste money.

Everyone dreams of a financially secure life. Don’t you know who I really need or expect from the poor? This is just an unfortunate cash tendency, lacking basic cash ability and clear goals, which makes individuals in a bad monetary state. If you become smart in money, You will benefit greatly from building a considerable retirement fund. You should simply learn and practice how to build long-term financial stability. This must be given to your children. This will mean that your children’s future will be in sharp contrast to your world. If you can show them the standard you want as soon as possible:

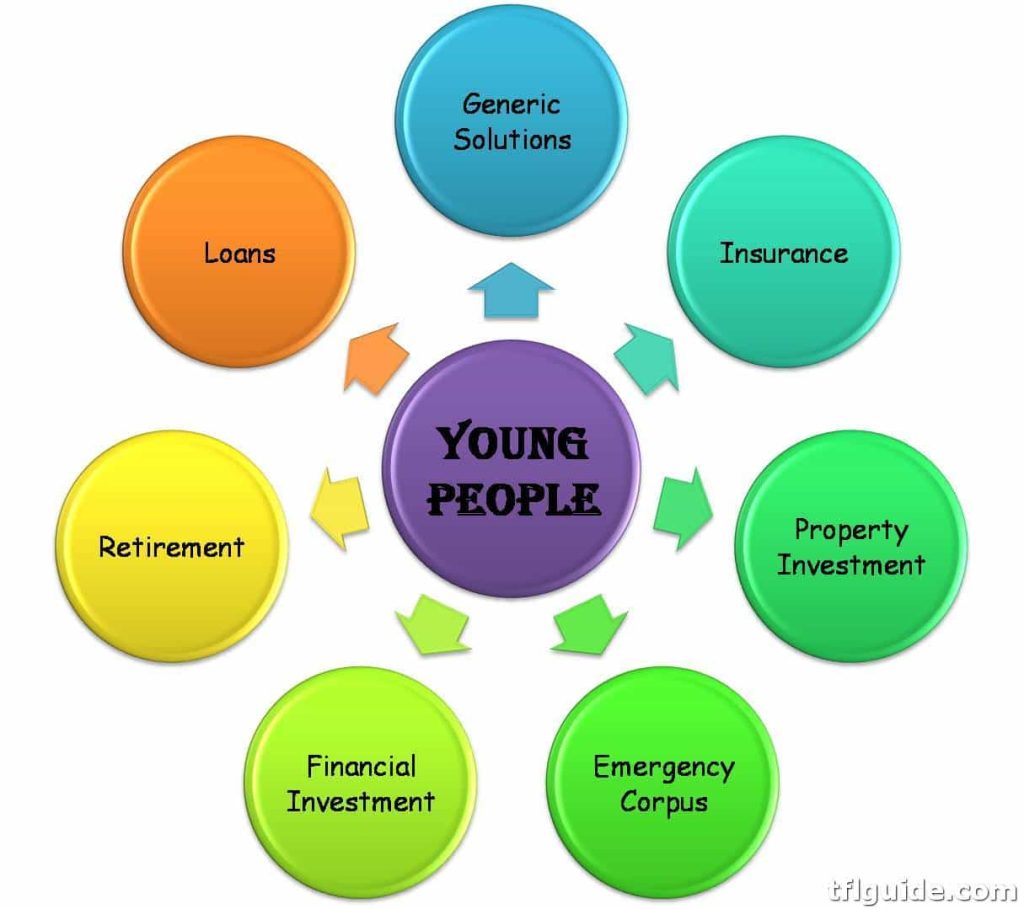

Appropriate investment methods may vary depending on their unique financial situation, objectives and risk perception. However, for young investors, the general techniques are as follows:

-

Start saving as soon as possible. The sooner you start saving, the more time you have to increase your money.

-

Invest in various assets. Diversifying the product portfolio among various asset types(such as stocks, bonds, real estate, etc.) helps reduce overall risk exposure.

-

Keep your expenses low. It is important to pay attention to the expenses related to your investment products.

On the contrary, what you should do is to live as much as a student. The first two years after graduation are the time for you to work hard to ensure your financial future. If you do not manage your savings, your investment will be difficult to manage.

If you are a newly graduated bachelor, your goal is to deposit half of the $1.2 million in the bank.

Start with balanced mutual funds with relatively low risk. Stick your toes into the water through these. Here is the list of balanced funds in India: the best balanced mutual funds in India. Related projects: online value review

So far, you should have known what mutual funds, SIP and other investment bases are. Next, we will start stock funds. At the initial stage of your experience, your goal is to hold more than 50% of stock fund investments. As you grow older, part of your investment will be transferred to bonds/bank deposits.

In short, the first rule of investment is saving. Unless you invest enough money, your rate of return will not matter. Once you establish your own safety net, you will invest in mutual funds, stock funds/stocks.

Considering our financial environment, you can imagine that it would be safer to hide your cash under the mattress like Grandma did in the past!