How Cryptographic Loans Work

How Cryptographic Loans Work

Some people are confused about the value of cryptocurrency and its efficiency as a means of storage and transfer. Cryptocurrency is sometimes referred to as ” alt connections”, an abbreviation for alternative currencies. The most famous of all cryptocurrencies is Bitcoin. Although there are many new competitors in the market, they are called altgones. Borrowers can complete complex archiving and processing tasks and succeed with competitive cryptocurrency loans and terms. Asset loan capital currently has high competitive interest rate of cryptofinance based on preferential interest rate. In addition, the loan term of the encryption borrower is 3 months to 10 years, which is an ideal time for individuals who want to repay the loan funds and reasonable time.

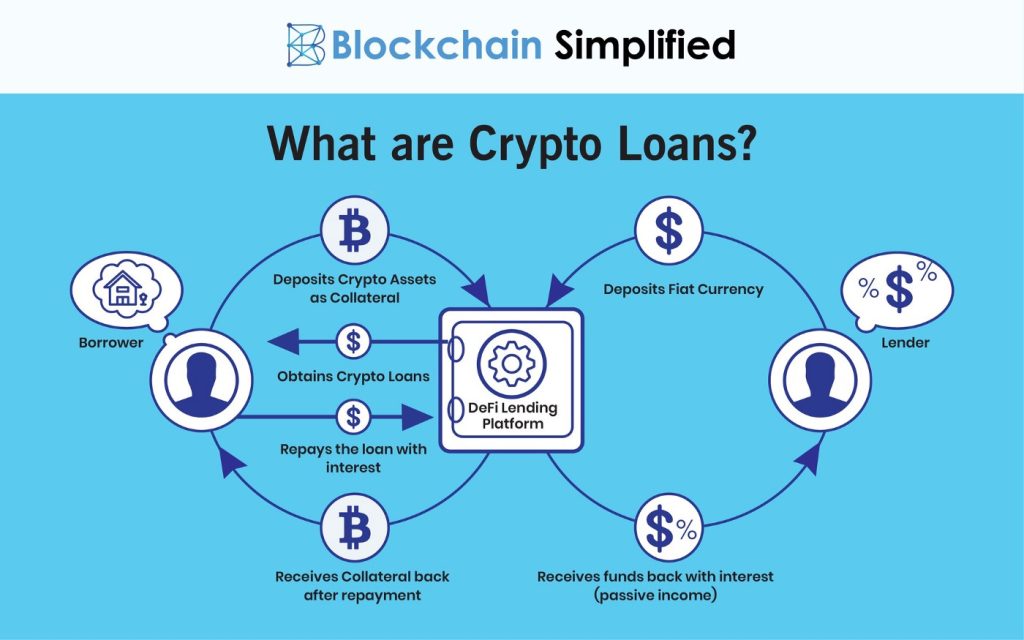

How does crypto lending work?

Sometimes, cryptocurrency holders and investors can get the fast cash needed to invest in other hard assets or repay debts, while helping cryptocurrency holders and investors hold cryptocurrency assets, which is considered as short-term to medium-term loans or cryptocurrency loans.

The amount of Cryptocurrency loan depends on security, liquidity, number of currencies held, price, volatility, trading volume and other standards of guarantee, approval and fund raising. During the term of the loan, we provide various interest payment options monthly and quarterly. We can simply complete this process. Once you repay the loan in full, your cryptocurrency or alternative currency will be yours in full.

How do I qualify for crypto loans?

All cryptocurrency wallet owners are eligible to apply for loans. The scale of encrypted loans may vary greatly depending on the borrower’s payment capacity and loan structure. The loan process is very fast, and the capital turnover time is usually within 48 hours after closing.

The main advantages of our crypto loans.

With cryptocurrency, everything depends on flexibility. Cryptocurrency loan provides the borrower with the opportunity to withdraw from the loan at any time without affecting the borrower’s credit score or liabilities. This type of loan has no debt problem and will not damage the credit score, so it is more attractive than traditional loans. Cryptocurrency loan structures are created by cryptocurrency lenders without collateral and personal guarantees.

What can my encrypted loan be used for?

• Expand or support the mining industry

• Entrepreneurship

• Repayment of credit card debt

• Complete the home decoration project

• Purchase of new real estate

• Buy new ships

• Buy new art

• For real estate development support

• Upgrading of mining equipment

• Reinvestment or trading

• Pay operating expenses for the business

• Large scale procurement, such as real estate development procurement

Almost anything you want to do with loan proceeds.

Basic requirements for encrypted loans

Ϩ The minimum loan amount is USD 250000 to USD 5000000

✓ Your cryptocurrency must be freely traded without restriction or interruption.

Ϩ Personal cryptocurrency not available in the current cryptocurrency wallet is not applicable

✓ All cryptocurrency owners in the world can borrow money, regardless of country

✓ All loans have no recourse, and the borrower’s liability is zero.

Cryptographic Loan Terms

✓ The loan value reaches 65% according to the personal cryptocurrency held

✓ Competitive interest rate, term interest limit clauses

✓ Crypto finance lasts from 3 months to 10 years

✓ Cryptocurrency should be secure in the cryptowallet, not in the transaction account.

Like many direct borrowers, the only collateral is a cryptocurrency wallet without background checks or personal responsibility. The borrower provides a competitive LTV based on market conditions, industry, cryptocurrency performance and future performance. The typical LTV range is 45-65%.

The borrower now provides competitive interest rates based on the most favorable interest rate and the loan term of 3 months to 10 years. Your personal information is very important, so your transaction is always confidential, and all personal information is stored securely.

Cryptographic loan process

-

You must move the cryptocurrency to the cryptowallet. Most cryptowallets will accept the highest cryptocurrency as collateral. Cryptographic deposit or withdrawal is generally free of charge.

-

Apply to the cryptocurrency borrower who provides the cryptocurrency held, the amount of currency held and the amount of loan required.

-

Loan approvals typically take 24 hours to publish a list of terms and conditions.

-

Loans are usually in euros, dollars and Swiss francs.

-

After signing the terms and conditions list and returning it to the lender, the lender will ask the lawyer to sign the final loan contract.

-

The final loan contract shall be signed by the borrower and the borrower.

-

The coins are then placed in wallets held by customers, temporary custodians and borrowers.

-

Immediately thereafter.

The typical loan amount is more than $250000, but the borrower’s benchmark loan size is between $500000 and $50 million. Although there are many large borrowers of encryption loan platforms, the safest way to accept encryption financing is to obtain high loan scale and personal transactions through private institutional borrowers, and more importantly, to quickly obtain loan funds.

Withdrawal options:

Withdrawal through SEPA and SWIFT bank wire transfer. Available worldwide.

The credit card is withdrawn by MasterCard or visa.

Go to lawyer account for best security