Five Facts About How To Realize Financial Freedom

Five facts about how to realize financial freedom

The realization of economic freedom is the desire of most people. Financial freedom means having enough savings, investment and cash to take care of lifestyle and others.

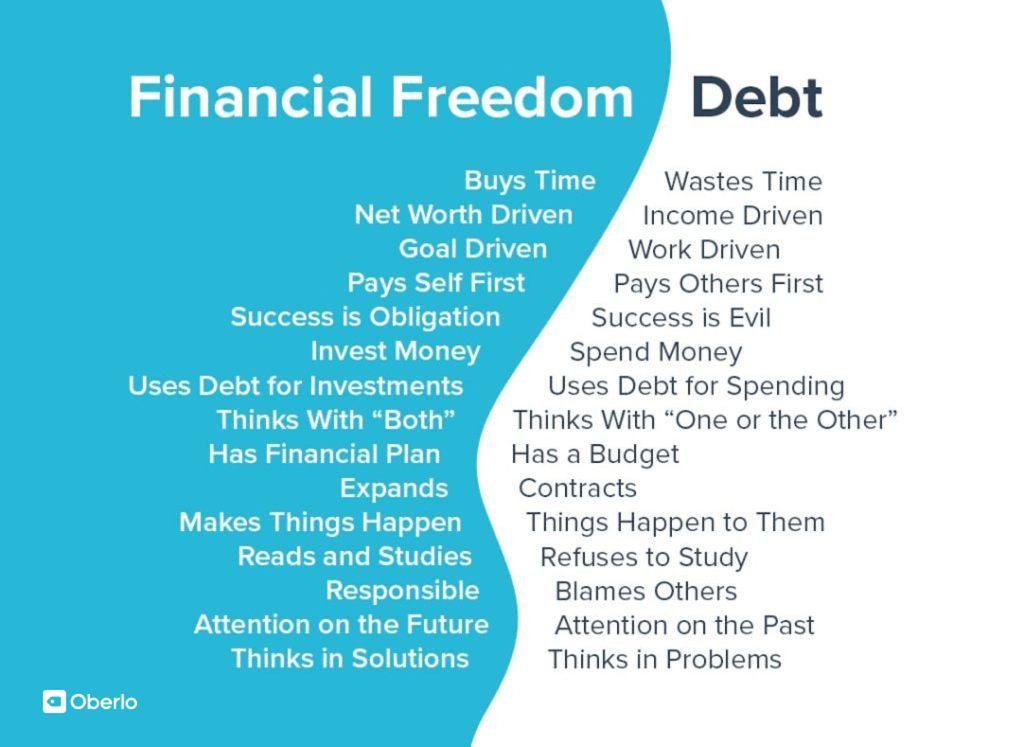

The road map to financial freedom is not a strategy to get rich quickly, nor is it a way to get someone off their financial responsibilities. Unfortunately, inflated debt, financial crisis and extravagant expenditure make it difficult to achieve financial goals.

The following are tips for personal financial freedom.

- Personal financial investigation

Fiscal freedom starts with listing all liabilities, cash, savings and investments, and building net assets.

Net value=(current+non current+other non current assets) -(immediate liabilities+long-term liabilities).

Current assets are easily converted into cash.

Non current assets are not easily converted into cash, such as residential buildings

Long term other non current assets(insurance products)

Current liabilities refer to the debts that must be paid within 1-2 years

Long term debt will be paid in a year or two

The net value of total assets should be positive.

- Make realistic budget

Making a budget and sticking to this point is the key to ensuring the payment of bills. At the same time, we should check the living expenses to alleviate the temptation of luxury consumption.

To achieve budget reform is to determine the areas of expenditure. The right savings plan comes from identifying where the money is leaking. Track expenditures from major invoices to coffee invoices.

- Develop debt repayment plan

Debt is the biggest obstacle to achieving financial goals. Some debts will generate high interest rates, so the split is low, and realizing debt freedom becomes a nightmare.

Getting out of debt is a step. All debts other than mortgages(mortgage tax relief) will also be exempted. Pay small debts first, and establish the momentum of liquidating huge debts. Once the debt has been repaid, its payment is transferred to other debt rather than included in the budget.

- Mobilization of emergency funds

The purpose of the emergency fund is to help you in times of financial difficulty. The fund provides a buffer against unforeseen events, such as unemployment or illness. “Everyone needs an emergency tank(money) to spend 3-6 months,” McGrath said

- Create multiple sources of income

Multiple sources of income provide individuals with multiple sources of cash flow. This is a response to unemployment or economic difficulties. Stable sources of income guarantee early retirement plans, debt repayment and future investment opportunities.

conclusion

Check yourself according to the tips in the summary and determine the part of the financial situation that needs to be modified. Saving money, controlling expenditure and minimizing debt can bring financial freedom. This ensures better support for yourself and your family. Who doesn’t want to get out of debt?