Do You Take Part In The Rat Race?

Do you take part in the rat race?

Have you ever asked yourself this question? I believe not. I am here to provide you with its details.

What is a rat race?

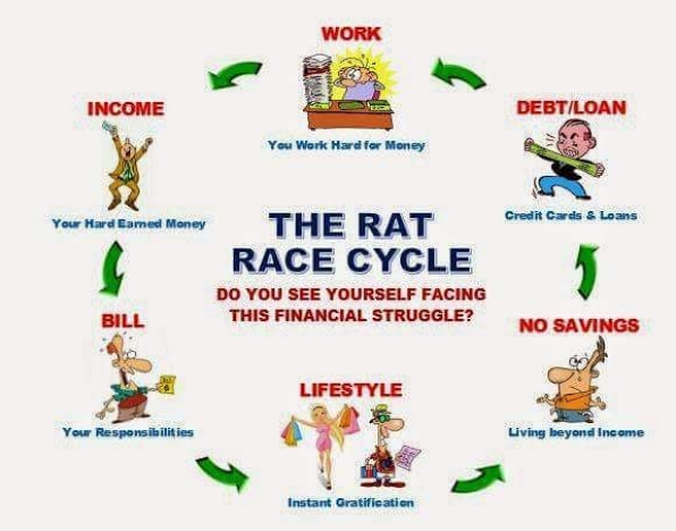

A common scene in our society is that parents with higher education or secondary education consider their children going to school, get good grades, and get honest jobs. These are what teach children to succeed. But in schools and society, the importance of cash and the way of managing money are ignored. Getting good grades and finding a good job is the core idea of most people. The employee must complete the work on a specific day or for a certain period of time, and he or she can only take a rest on a specific weekend. Due to the lack of sufficient knowledge, they fell into a financial crisis in meeting their needs. This is mainly because these people work hard only to make money. They just run around solving their financial problems. This has happened for generations. The so-called rat race.

How to get rid of this “rat race”?

The solution can be rounded in your mind. Guess what the solution is!

Understanding accounting and investment is the way to solve problems. We have things that we haven’t learned in schools and universities. How to get high scores and high paid jobs. It is fear and ignorance that make people poor, not the government and the rich. People struggle between fear and ignorance. Investment is part of income. Most ordinary people only spend the money they earn, without considering investment. When we heard about “investment”, we considered a lot of money. But it doesn’t make sense. You can invest a little every month to build a great company.

To get out of this circle, you must know the rules of making money.

There are three types of income sources:

Positive income(work hard for money)

Passive income(making money work for you)

Portfolio income(investment)

We just work hard for money, but we don’t know how to make money work for us. We can create such a beautiful source of income without active work such as courses, book writing, content production and investment.

For financial stability, one should create more assets than liabilities. Creating assets means paying yourself first, which means leaving some of the income to buy assets before investing in securities. In order to create assets, expenditure must be reduced.

Investment and assets work for you.