As Liquidity Dries Up, IPO And SPAC Begin To Circulate In An All-Round Way

abstract

-

Compared with a year ago, the capital market is more depressed because the number of IPOs and SPACs has decreased dramatically

-

Investors strive to cope with the changing macro environment, while bankers strive to cope with higher capital costs

-

Traders must pay close attention to the expiration date of the stock lock up period. Because the company events that fluctuate in this market will lead to a surge in volatility

The performance release season of the first quarter was mixed in the financial industry. Factual data shows that although the Group reported the third largest total income surprise among 11 industries, the growth of gross profit per share(EPS) in the financial industry changed to – 19.8%. ¹ Citigroup and Goldman Sachs reported strong profits, and Brian Moynihan of Bank of America was optimistic about the consumer situation. Jamie Dimon of JPMorgan Chase listed many challenges facing the world macro-economy, but he was not so optimistic.

Breaking the foam

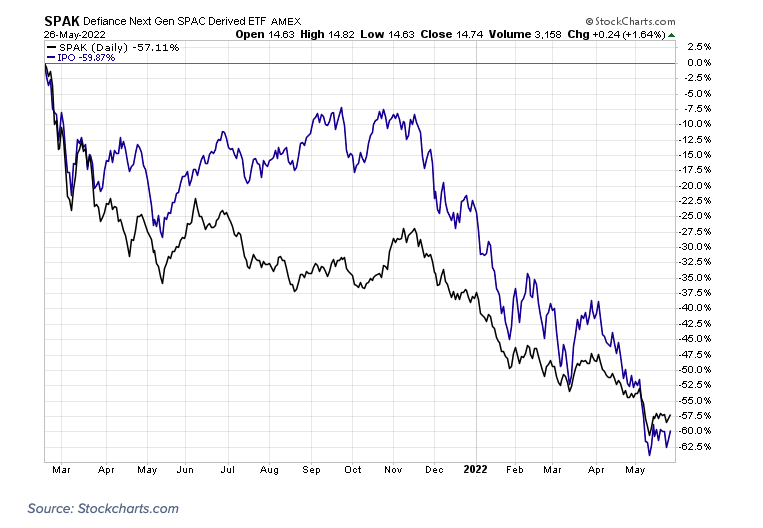

Nevertheless, there is no doubt that the capital market is different from the beginning of 2021. A year ago, corporate public offerings(IPOs) and special purpose acquisitions(SPACs) also gained high popularity. From the results of tracking the two once popular exchange traded funds in these fields, we can see that the Defance Next Gen SPAC derivative exchange traded funds(SPAK) and Renaissance IPO exchange traded funds have both fallen more than 50% from the historical high in February 2021.

Capital market: from hot to cold

Low interest rates and the surge in the money supply contributed to the climax of capital raising. People have more cash than they know, so investors use it for promising(and less promising) investments. Facts have proved that, at least from the trend of the past 15 months, this is another good sum of money. In November last year, the Federal Reserve(Fed) began to announce higher interest rates in advance, the company’s future cash flow was significantly discounted, and investors have stepped out of IPO and SPAC space.

IPO upsurge planning

Wall Street Horizon closely tracks capital market data. This helps customers understand global market trends in order to manage risk. Our data highlights the level of buyer activity at the beginning of last year. According to our statistics, the IPO boom reached its peak around the end of the first half of 2021. From the second quarter to the third quarter of last year, there were more than 250 IPOs worldwide. Both the fourth quarter of 2021 and the first quarter of this year are below 200. The figures for this quarter are insignificant compared with the same period last year.

SPAC speculation

The number of tape hits in SPAC is an amazing trend. In the first quarter of 2021, 251 companies were listed through Spark, which was consistent with the highest ETF price. In the following months, the market cooled. Although there was a small peak at the end of last year, the circulation of SPAC in this quarter was still very low.

In the first quarter, the total amount of SPAC decreased by 57% year on year, while the number of IPOs decreased by only 13%. But SPAC is still much more popular than FANDEMIC before. In addition, from 2022 to now, there are more SPACs than existing IPOs.

Lock risk

An important corporate event related to a listed new company is the expiration date of the lock up period. There is no doubt that the stock price is driven by changes in supply and demand. When the stock supply flows into the market, volatility will occur. Look at what happened in Levian a month ago. After locking the expiration date on May 8, the stock collapsed. On Tuesday, the electric car maker’s share price fell below $20. After the selling pressure eased, the stock rebounded later. At 11:00 a.m. on Monday, June 6, Pacific Standard Time, please keep an eye on the Rivian Annual General Meeting.

conclusion

The change in a year is really great. We have seen this in stock and bond prices and in the capital market as a whole. With the sharp decrease of IPO and SPAC activities, the profits of investment banks may be under pressure for the rest of this year. For traders and fund managers, paying close attention to the situation of the primary market and the company’s listing is helpful to measure risk appetite. There is no doubt that the rapidly changing macro environment is affecting the global market.

¹

²

³

⁴ ; compare=IPO&;id=p85591626951

⁵ ; p=D&;yr=0&;mn=8&;dy=0&;id=p53672281976