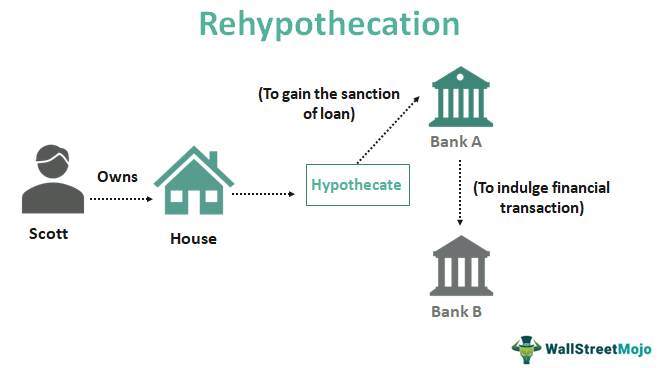

What Is Rehypothecation?

People sometimes get confused. “Why do people want to mortgage again”; there are many reasonable reasons for people to re mortgage their property. If you have a mortgage now, the monthly repayment is high, but the income remains unchanged. This is a good example of your financial situation. Your real estate market value is very low, so far you have not improved. In short, you can say your mortgage is as good as the new one.

This applies to you if you are refinancing at a fixed rate. Basically, you add the value of your existing mortgage to the cost of your new home renovation work, and then apply for a new loan: rehypothecation. The only difference with this new agreement is that now you have to pay a slightly higher interest rate. Because if you break the contract, the new borrower may lose his money. Borrowers get higher interest rates because they know that if they do not repay all the loans on time, they will lose all the capital needed for the loans. This is why before you decide to adopt an interest rate that may be higher than the current monthly interest rate, you always need to ask whether you can use the fixed interest rate for rehypothecation.

Another good reason people choose to re mortgage is to borrow more money to improve their houses. As the initial repayment time is short, you can borrow more money from this re mortgage. This is the time from the day you apply for the loan to the day you finish the house decoration. Therefore, if you want to expand the courtyard area or buy new furniture, you cannot borrow money in a better way than re mortgage. This is also an ideal choice for those who want to spend a little money at home to do other home decoration.

If you recently owe new or expensive debts, you can consider applying for re mortgage. Many borrowers want to obtain personal loans facing short-term economic difficulties. As long as they can provide reliable repayment plans, they want to show them how they will repay new loans. It is important to remember that the longer it takes you to repay your existing home improvement work, the more backward you will be and the more likely you will lose any further progress. If you fall behind, re mortgage will only let you catch up and let you continue to enjoy your current lifestyle.

If you find yourself unable to pay your mortgage, your lender will usually give you the “cash” option at the end of your ltv trading term. Then, you can use the cash to repay your debts and sign a new mortgage agreement with the bank, effectively eliminating the interest and other expenses incurred. In many cases, you can also transfer your house to the security interest part of the LTV transaction to release some interests, thereby increasing the interests of your house. However, your lender usually allows you to enter an ltv arrangement. If you can actually keep up with your existing mortgage payments. If you don’t do this, your house will face risks even if the current mortgage is still valid.

One of the main advantages of the rehypothecation transaction is that it can save money from all the expenses of the real estate. Even if you need to consider the extra cost of paying a builder or renovating a property, the savings from rehypothecation are significant. When you mortgage again, the amount you save is almost always higher than the value of the real estate itself. Therefore, it is important to keep up with ongoing maintenance costs that may reach thousands of pounds per month, in addition to paying the builder or refurbisher. In addition, there may be a need to improve the building itself, such as maintaining the interior and exterior of the building.

Another advantage of rehypothecation is that it can give you financial security. As the original mortgage was repaid in installments over the years, the final monthly repayment was much less. That is, with the extension of the repayment period, the monthly expenditure will also decrease. Therefore, you will soon find that you need to worry about more loose income and less debt. Most importantly, if the rehypothecation plan is implemented, more money can be borrowed. Therefore, if there is an opportunity to obtain more mortgages and extend the loan term, the monthly expenditure will be reduced.

If you are considering rehypothecating, you must first make sure that the deal you get is worth it. Just because your house price is rising, borrowing money is not a good idea. In its place are fixed rate, low rate or variable rate mortgage transactions. Check the various quotes provided by each lender online to get the best possible deal. Although the initial cost of rehypothecation may be high, it will be compensated in the long run. Because you have to reduce your monthly payments and improve your credit score.