Understand Cash Flow And Assets

Should you apply for an asset based loan or a cash flow based loan for your business?

Both types of loans can provide entrepreneurs with the funds they need, but which one is more suitable for you depends on the type of company you operate.

What are cash flow based loans and asset based loans, and what are their advantages and disadvantages?

What is Asset Based Loan?

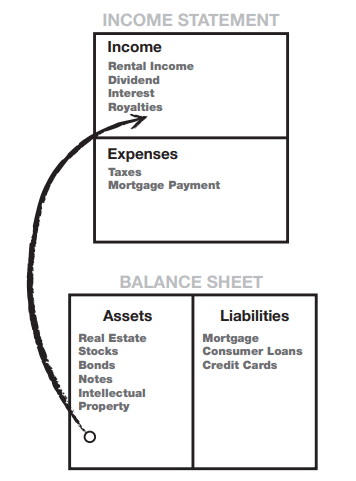

Asset based loans are loans based on the following asset values:

• Receivables(receivables are unpaid invoices for goods or services delivered by your company) or

• An interest in all land or buildings owned by the Company.

The borrower can prepay 90% of the amount of receivables to you in the form of repayment credit, as shown in your balance sheet.

The actual amount you can borrow also depends on your borrower’s credit rating of your typical customers. If your turnover increases, the amount you can borrow will also increase.

alternatively, you can provide the following guarantees:

• Company inventory(materials, goods, commodities and other items that your business can sell for profit) or

• Balance sheet assets(tangible assets such as vehicles and fixed assets such as equipment and machinery).

If you provide your inventory or assets as security, the value that the borrower gives them is only their auction value, not their actual market value. That means you can’t borrow the money you might need.

Asset based loans are generally more suitable for companies with low profit margins and large balance sheets.

This is because companies with low profit margins often find it difficult to generate the cash needed for general transactions and growth. Moreover, because loans are secured, interest rates on asset based loans are generally low.

What is a cash flow loan?

Cash flow based loans are companies or collateral with high profit margins, more suitable for companies with insufficient hard assets, and can provide guarantees for borrowers.

Cash flow loans are very popular with service companies, marketing companies, manufacturing companies and retailers with low profit margins.

For cash flow loan application, the borrower checks as follows:

• Credit rating(personal credit and corporate credit);

• Your “; enterprise value”;(Market value of the enterprise)

• Your expected future cash flow(that is, the amount your customers can pay from your sales in a given period of time) and

• Deposit frequency(sometimes referred to as “cash flow consistency” when actual payment is received)

In order to confirm how much money they will actually lend you, lenders first consider your company’s EBITDA(EBITDA – a measure of your profitability).

They then apply the credit multiplier to the margin. Different industries have different credit multipliers, which are used to measure the risks associated with corporate loans from different industries.

This financing method allows the borrower to take into account the possibility of future recession that a company like you may face, and maximize the funds available to you.

You do not need to provide any collateral to the borrower as security for the cash flow loan. But it does mean that you pay a higher interest rate than an asset based loan.

If you think cash flow loans sound like invoice financing, you are right, but only to a certain extent.

With invoice financing, you can only borrow money through the invoice completed by the order. But if you use cash flow based commercial loans, you can actually borrow money based on future income and invoices.