What Is Index Universal Life Insurance?

What is Index Universal Life Insurance?

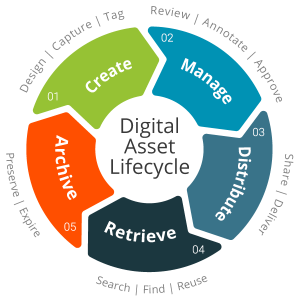

As a permanent life insurance, the index general life insurance has a cash value in addition to the death insurance premium, which is similar to the life insurance, but also means that there is additional insurance premium. The cash value account is a stock index selected by insurance companies(such as S& p500 or NASDAQ Composite Index or Credit Suisse Index), which is usually not a fixed rate of return but a guaranteed interest rate. In the rest of this document, the general life of the index is called IUL.

Key Features of IUL Insurance

No fixed interest rate: The National Association of Insurance Experts(NAIC) explained that when buying IUL, the money in the cash value index account will not earn a fixed interest rate. Instead, your interest rate is based on the market index selected by your insurance company. According to the Securities and Exchange Commission, the index tracks how specific types of investments such as stocks or bonds emerge. NAIC said that insurance companies choose the index and then calculate the interest rate according to the performance of the index. Then the life insurance company will charge the interest to your cash value account.

Interest rate guarantee: NAIC also said that since the policy generally includes interest rate guarantee, even if the index creates low returns, it will also pay the minimum interest rate. But interest rates are also generally applicable. “; hat”; or the most concerned thing.

Adjustable premium payment(within the limit): 1 Your insurance policy can specify the plan premium for you. However, if the cash value account has sufficient funds, these funds can be used to pay the insurance premium.

Adjustable death allowance: death allowance is usually flexible in IUL policy and can be reduced at any time. However, if you want to increase the death benefit, you may need to undergo a medical examination and pass it.

Obtain cash value: You can borrow money from IUL in an emergency, but it is likely to incur interest expense. Although withdrawals from cash value accounts are also allowed, this will permanently reduce death benefits. Withdrawal may also invalidate your insurance policy.

Lifetime income: Cash value can accumulate enough time to provide lifelong tax-free income for policyholders by withdrawing money every year or every month. Tax exempt status is possible. Because it is a life insurance, the withdrawal is less than the total value, and the investment is after tax.

Advantages of IUL Insurance

Low price: the applicant bears the risk and the premium is low.

Accumulation of cash value: the amount calculated in the cash value will increase the tax exemption. The cash value can pay the insurance premium, and users can reduce their own insurance premium or stop paying.

Flexibility: The policyholder controls the risk amount of the index account, and the death pension amount can be adjusted as needed. Most IUL insurance policies provide a series of additional clauses, ranging from death benefit coverage to no failure coverage.

Death pension: This pension is permanent and does not require payment of income tax or death tax, nor does it require probate.

Low risk: the policy does not directly invest in the stock market, reducing risk.

Easier allocation. The cash value of the IUL insurance policy can be obtained at any time, regardless of the individual’s annual order, without penalty.

Unlimited benefits: The IUL policy does not limit annual benefits.

Disadvantages of IU insurance

Upper limit of cumulative ratio: Sometimes the maximum participation rate set by insurance companies is less than 100%.

The larger the face value, the better: The smaller the face value, there is no great advantage compared with the general UL insurance policy.

Stock index basis: the index falls, and the cash value will not be included in the interest.(Some policies provide lower margin interest rates for a longer period of time.) The performance of investment instruments is based on market indexes. Their goal is to surpass the common index. The goal of IUL is to profit from the rise of the index.

Construction takes time: unless you win the lottery, opening IU after a certain age is futile. It takes years to grow. From birth to 50 years old, it is a good window to open IU.

Who chooses IU insurance?

IUL is a good choice. If lifelong life insurance and the ability to establish long-term cash accounts, anyone can find permanent life insurance.

NAIC pointed out that IUL insurance provides market based growth potential and protection against loss of value when the market falls. If these features are attractive to you, you can consider IU insurance.