Bank Guarantee BG And SBLC

What is a bank guarantee?(Background)

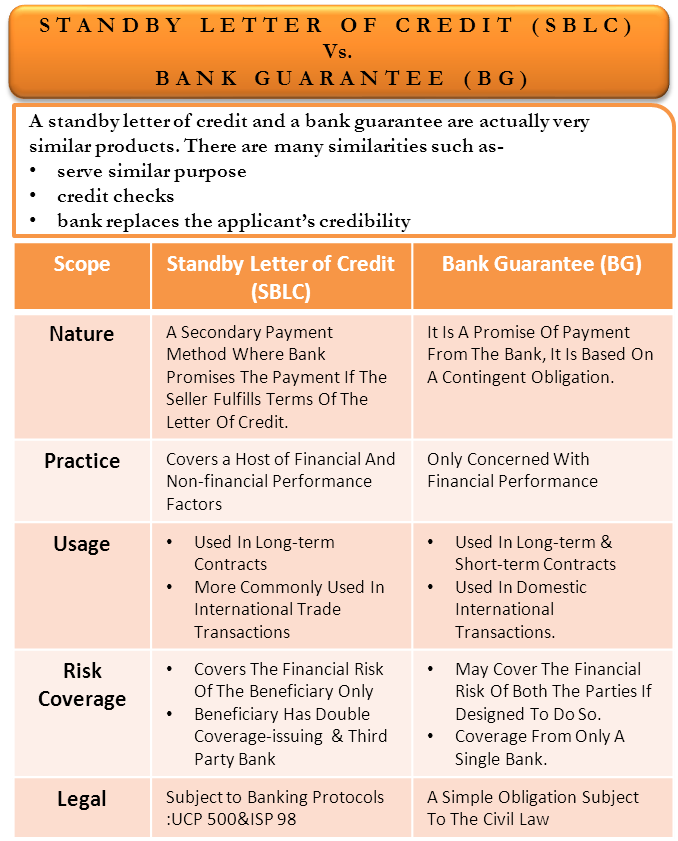

Bank policies(BGs) are used for many types of commercial transactions(financial or results based) and are therefore very similar to standby letters of credit. The real difference between the two is that the letter of credit(LC) guarantees that the commercial transaction will be carried out as planned, while the bank guarantee(BG) reduces the loss when the commercial transaction is not carried out as planned. Bank Guarantee(BG) provides a certain amount of guarantee for the beneficiary, such as failure to perform specific obligations under the contract agreed by the other party. The Bank Guarantee(BG) ensures that the parties to the contract are not exposed to credit risk.

The construction company and its steel beam supplier can sign a contract agreement to build a new complex.

Both parties may have to issue a Bank Guarantee(BG) to prove each other’s credit value.

If the steel beam supplier cannot deliver the steel beam to the construction site according to the contract agreement agreed by him, the construction company will notify the issuing bank to pay the amount agreed in the bank guarantee to the construction company after violating the terms agreed in the bank guarantee(BG).

How does the Bank Guarantee(BG) process work?

Bank Guarantee Procedure

Step 1: Apply

Fill in the Bank Guarantee(BG) application together with the transaction documents and return it.(Contract, agreement, etc.) Bank guaranteed lender.

Step 2: Issue bills of exchange

SWIFT MT 760 draft of Bank Guarantee(BG) will be reviewed by you and your beneficiary.

Step 3: Initial Payment and Initial Payment

a) Finalize and sign the bill between you and your beneficiary(change is free).

b) We will issue the payment invoice of BG for you, and you will arrange the payment.

c) After receiving your telegraphic transfer payment, we can issue and deliver the final bank guarantee(BG) to the bank.

Step 4: Publish

Generally, banks issue bank guarantees(BGs) within 48 hours of issuance.

Once issued, a copy of the Bank Guarantee will be emailed to the Beneficiary via MT760 SWIFT in full, including the reference number of the Bank Guarantee.

Your seller’s bank will soon receive and confirm the Bank Guarantee(BG) issued by the lender’s providing department.

What are the types of bank guarantees?(Background)

There are many different types of bank policies. Do we list some of them for you below?

1. Bid Security:

Issued as part of the bidding process between the contractor and the project owner to ensure that the successful bidder performs the contract in accordance with the terms and conditions of the bidding.

- Performance Bond:

A letter of guarantee, usually issued by a bank, to ensure the successful completion of the project by the contractor. This is called the letter of guarantee of the performing bank.

Also called contract bond.

3. Advance payment guarantee:

The contract includes the advance payment to the seller, which can be used.

It guarantees that if the seller fails to fulfill its obligations to the seller, the advance payment will be returned to the buyer.

- Quality guarantee:

Contractor’s Letter of Guarantee with Credit History

Customers will be protected if they do anything that is not qualified or ethical in all aspects.

5. Payment Guarantee:

A financial commitment that requires the debtor to repay its debts in accordance with the terms set forth in the debt agreement.

6. Rent guarantee:

An insurance policy that protects homeowners from loss of rent

7. Letter of indemnity:

Letter guaranteeing compliance with some contract provisions or making financial compensation.

If it fails to meet the provisions of the contract, it shall be guaranteed that it will not be damaged.

- Payment guarantee certificate:

On the basis of the letter of credit issuing bank’s commitment to pay the supplier, the bank will provide payment guarantee on a specific due date.

What is the process?

The institution currently provides non recourse loans under the Bank Guarantee(BG/SBLC) as collateral for the monetization process. The plan can generate investment funds for trade financing, construction, credit enhancement, government financing, real estate investment and various financing. The institution can provide LTV 100% non recourse loan through the BG lease monetization project. The following are the transaction procedures and bank transfer fees for BG/SBLC financial institutions to deliver the BG/SBL monetization plan.

BG/SBLC plan:

1: After our legal department has investigated and confirmed the authenticity of the lender’s company/identity, the lender should conduct a financial, corporate and job investigation on the lender’s company. The borrower and the borrower sign and sign this agreement and start signing the contract. This will automatically become a complete commercial recourse contract for both parties to start Swift Transmission.

2: Within 3 days(three days) after the legal department confirms the authenticity of the borrower’s documents, our financial department shall send a copy of the letter of intent with signature and seal.

3: After receiving the signed and sealed letter of intent from the borrower and confirming it, the financial department shall, within two(2) banking days, issue the signed copy of the contract to the borrower, and after sealing, send the signed copy to the borrower to complete the contract.

4: After the borrower receives the borrower’s contract,(1) within banking days, the borrower will send a copy of Advance Payment Guarantee APG or Payment Refund Guarantee PRG. This copy shall be duly signed and sealed by the borrower’s bank. The Bank guarantees any delay or default by the Lender. When the borrower makes a request to us for the first time, any advance payment will be returned together with a penalty of 1% and a signed and sealed payment receipt. The borrower only pays 50% of the bank’s transmission, administrative and financial expenses. The handling charge of non recourse loan shall be directly remitted to the bank provided by the borrower through SWIFT MT103.

5: Within 3(3) banking days after confirming receipt of 50% of bank transfer, administrative and administrative expenses; the fees for processing the non recourse loan in the bank account designated by the borrower through SWIFT MT103, and the borrower delivers the non recourse loan(cash loan) to the bank account provided by the borrower through SWIFT MT103.

The borrower pays 5% rent to the bank account designated by the borrower every year through Swift MT103, and the initial balance is 50% of the bank transfer, administrative and administrative expenses. Service charge for telegraphic transfer

6: Within 5(5) working days after Swift MT103 delivers and confirms the non recourse loan on the bank account designated by the borrower

It is prohibited for the parties or agent lawyers to conduct unprovoked telephone investigation or communication with the bank in an improper way in this transaction, and terminate the contract.

The 5% loan value fee will only be paid within 10 years, after which the loan will become a non recourse loan.

Note: Only 50% of the required processing fees need to be paid in advance.

Then we successfully borrowed money from our financial institutions.

Why choose BG and SBLC currency suppliers?

1). Guarantee: BG and SBLC currency providers guarantee the successful financing of the project. In case of failure, 100% swift fee and 1% penalty will be refunded.

2). Speed: It takes 5-10 working days at most to fund the project.

3). Reliability: For suppliers, trust is very important. Since 2012, they have supported entrepreneurs to successfully run their own businesses.

4). Experience: The supplier’s trained experts will contact the legal department and ask for all necessary steps. They developed a time tested approach to all their actions.

5). Risk free: Prepayment Guarantee APG or Payment Refund Guarantee PRG will be officially signed and sealed at the borrower’s bank. This means that the cost is 100% guaranteed and the supplier is helping the customer to obtain funds at the lowest cost.

6). Insurance: Set up insurance rights for you and your enterprise. This helps customers join their projects. Even if their project fails, they are not worried because the insurance company bears the loss.

The lease bank guarantee is the transfer of collateral.

The term “lease” or “lease” of bank guarantee comes from the structure of collateral transfer transaction. This Guide explains why misleading statements such as “Lease Bank Guarantee”, “Lease Bank Guarantee” or other forms of claim withdrawal guarantee(including standby letter of credit) are confused with collateral.

Transfer facilities. So why do they call bank guarantees “leasing”? The term “lease” or “lease” for bank guarantees derives from the structural basis of collateral transfer transactions(discussed in detail on this website later). The term “lease” directly related to bank guarantee, standby letter of credit or other forms of “demand guarantee” is completely misused and should be avoided; although we all agree, this layman’s term is used when people refer to financial instruments related to the implementation of banking instruments(such as these customized financing contracts). As we discussed, a lease bank guarantee or a lease standby letter of credit(or other type of guarantee for immediate payment) is a common term associated with collateral transfer loans. Therefore, the words “lease”, “lease” or “lease” are not actually correct because they cannot lease the bank.

What are the advantages of BG/SBLC applicants?

Most of the applicants applying for bank guarantee or standby letter of credit and bank guarantee through collateral transfer mechanism are to raise credit or loans. Generally speaking, applicants may not be able to borrow money from their own banks due to insufficient existing guarantees, or credit expansion is too far away. Sometimes, the goal is to raise funds for new companies, trade locations, and large projects. As the collateral injected into the collateral transfer loan is used for credit support, the collateral can be directly used from the receiving bank holding the collateral or other third-party borrowers to guarantee the credit line and loan. In this case, our borrower will be happy to provide a credit line that we can guarantee and facilitate

Our customers. Collateral transfer loans(“loans”) can also be used to improve financial conditions, enter into transaction plans, guarantee bills of lading, issue contractual guarantees, guarantee supplier payments, and other purposes.

So why do they call bank guarantees “leasing”?

The term “lease” or “lease” for bank guarantees derives from the structural basis of collateral transfer transactions(discussed in detail later in this series). The term “lease” directly related to bank policies, irrevocable standby letters of credit or other forms of “WYSIWYG NOT POLICY” is totally inappropriate and should be avoided. Although we all agree, this layman’s term is used when people refer to financial instruments related to the implementation of banking instruments(such as these customized financing contracts). As we discussed, a lease bank guarantee or a lease standby letter of credit(or other type of guarantee for immediate payment) is a common term associated with collateral transfer loans. Therefore, the terms “lease”, “lease” or “lease” are not really correct. Because the bank guarantee in the exact sense of the word “lease” is actually impossible to lease. Similarly, no standby letter of credit, invoice letter of credit(DLC) or other form of invoice demand guarantee may be leased(Uniform Rules for the Publication of Invoice Demand Guarantees(No.758 – “URDG758”).

In addition, you cannot purchase or purchase a bank guarantee, a standby letter of credit(SBLC) in full form or other forms of a guarantee for payment of invoices at sight, as defined in URDG758. Similarly, you cannot sell, as you will explain later on this page.

Therefore, the term “lease bank guarantee” is used improperly. As we have accumulated more than 150 years of experience in the industry, we believe that inexperienced intermediaries, intermediaries and suspicious entities are “suppliers” of these facilities and have used incorrect terms in official documents. We believe that inexperienced intermediaries have mastered these incorrect terms. Because the process of collateral transfer almost completely reflects the process of commercial leasing. In fact, the provider provides the recipient with the temporary ownership of its assets in exchange for expenses, and the assets are restored to the provider’s ownership when they are due.

The assets are used to raise specific, non transferable bank compensation that can be used by the recipient.

Therefore, this is because, as a misnomer, no lease actually occurred. Through the collateral transfer contract(the basic agreement for collateral transfer loan), the supplier transfers its assets

The bank will become the bank that the designated supplier issues collateral, known as the “issuing bank”. Generally speaking, the underlying physical assets pledged to the issuing bank as collateral are physical cash or immediately liquid stocks or commodities, such as listed stocks or gold bars or assets that can be liquidated immediately by the bank.

According to the instructions of the provider, the issuing bank will attract(mortgage or “freeze” in its own favor) assets and claim bank compensation(guarantee) for such assets to the consignee(referred to as the beneficiary in the expression of the bank guarantee). In this case, bank compensation is collateral.

As we have learned before, the collateral is generally in the form of a bank guarantee(bank guarantee) issued to the receiver, especially for the purpose of transferring the loan with the collateral. Sometimes the collateral may be a standby letter of credit or other form of specific demand guarantee, depending on the transaction jurisdiction and the parties. In addition, it varies according to the purpose and the specific customized terms of the relevant collateral transfer contract or contract.

Collateral transfer loans are very useful when a company or company needs to import, strengthen or add collateral to support additional credit lines or loans. The Company can introduce subordinated mortgage or additional collateral to provide necessary loan guarantee for banks and borrowers through this type of loan.

Bank guarantee or other forms of bank compensation or demand for immediate payment of guarantee as collateral loan, generally referred to as “monetization of guarantee”. A person who lends money with this type of bank note or collateral is often referred to as a “monetizer”. These terms are intermediary terms or slang that can be found on the Internet. In a professional environment, such loans that can be guaranteed as bank collateral have traditionally been correctly referred to as “Lombardy loans”.