Economic Downturn Refers To The Neighbor’s Unemployment

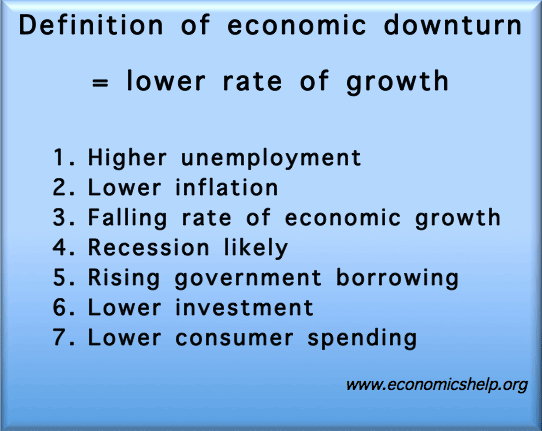

Balance You know, when one market starts to collapse, an economy is dangerously close to recession. You can identify which markets are in trouble by price. A market economy like ours always pursues equilibrium. If there are not enough goods or services, prices will rise. Ideally, if more producers or suppliers enter the market, prices will fall.

But for more than a year, our economic prices have become higher and higher. In short, the economy is now in an unbalanced state. This imbalance began in the energy industry late last year. The new President Biden will replace the existing energy system with one of his main goals. Please note that it does not matter to the market what kind of system Biden chooses as a substitute. Importantly, these new systems cannot generate more energy than previous systems.

Yes, Biden is taking advantage of the great change from fossil fuel energy to renewable energy. This may be a noble goal. Biden first closed the remaining resources, closed the Kiston pipeline, canceled the oil and gas lease of the Federal Land Corporation, and now apparently canceled the offshore oil lease.

Look at the president’s tendency to cut off Russia’s natural gas supply. He did all this before we found a suitable replacement. The sudden action cut off 10% of the US natural gas supply. A more prudent measure would first be to replace the supply with Saudi Arabia or Venezuela. He is now taking such measures after his death. If Biden replaces Russia’s supply first, we can tell Russia. “Hiking” will not cause today’s terrible inflation.

I hope you see that the President’s motives have nothing to do with the economy. In order to maintain economic balance, we must balance energy supply and energy demand. Biden didn’t do that. We are blindly in short supply. This is why energy prices are rising.

Therefore, energy is the first market where inflation is rising, and also the first market where inflation is soaring.

Now we see a similar pattern in the food market. Yesterday, food inflation surpassed energy inflation for the first time and became the primary factor driving producer prices. As discussed earlier, inflation may lead to infectious diseases. The price rise of one industry leads to the price surge of another industry. Of course, food and energy are closely linked. Agricultural equipment and machines cultivate the soil, trucks and trains transport food. Petroleum is an important component of the most widely used commercial fertilizer type.

At present, the rise in food prices is exacerbated by several factors beyond the control of the President or anyone, such as weather, natural disasters, drought, and the strangest is the mysterious factory fire. Recently, Hurricane Ian is expected to have a serious impact on Florida’s crops and is entering the harvest season.

“;” Natural action “; these factors may be enough to cause food prices to rise more than fuel costs. But taken together, it means that we can clearly see that food prices have risen fastest in China’s history.

This is not a question of demand, but of supply. In the past inflation period, when our population and economy grew rapidly, we faced demand inflation. At that time, the growing consumer group exceeded our production enterprises.

With the rapid aging of the population, today’s economy is showing steady growth. Our trouble now is not from demand, but from insufficient supply. Insufficient fuel and food. As the name implies, supply chain. Overseas manufacturers mainly come from Asia, especially China, and their output has declined.

It is in this thin supply chain that our economic destiny is determined. If the supply problem is not solved, we will fall into a deeper and deeper commercial abyss. To solve these supply problems, the economy will recover and prices will return to equilibrium.

Oh, yes, the rest of Ronald Reagan’s quotations are as follows.

“A recession is when your neighbor loses his job.

Depression is when you lose yourself.

When Jimmy Carter loses him, he will recover;

This is what happened.

Notes:

In a few minutes, we will get the most interesting economic report this month – the latest consumer price index report. Because the postponement will control inflation as the primary goal. CPI is the most popular of all inflation indicators.

Today, from my point of view, this is a duel between food and fuel. Recently, we have seen a slight drop in the energy market and a sharp drop in gasoline prices in the past few weeks. But food prices are rising. As we saw in the producer price index yesterday, food inflation surpassed energy for the first time and became the number one factor in wholesale inflation.

Wall Street predicted that the CPI inflation rate would decline slightly this morning, but the inflation rate would remain above 8%, which opened the green light for raising interest rates when the meeting was held again on November 1 and 2.

Do you want to know what effect cheap and sufficient energy has on your inflation rate? Saudi Arabia has just reported that the inflation rate this year is only 3.1%. Or, just slightly higher than the target inflation rate for the country.

Isn’t it interesting?